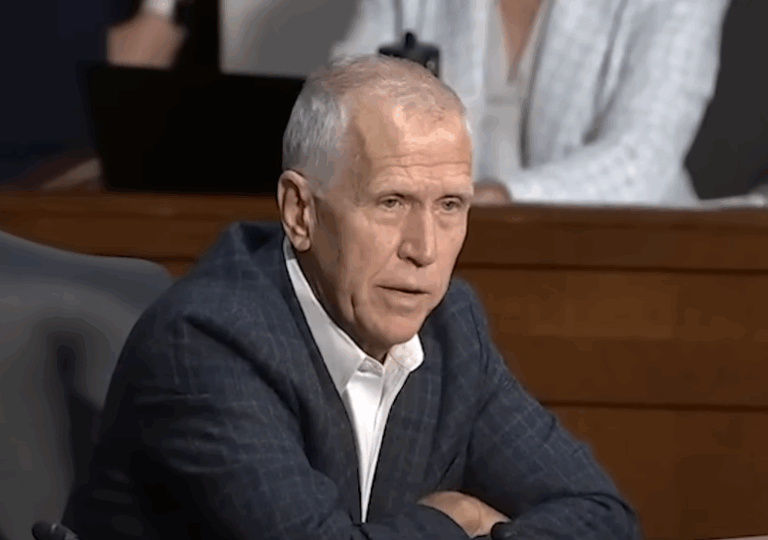

Senator Thom Tillis is a prime example of how policymaking and personal finance can coexist. Tillis is ranked 98th among members of Congress with an estimated net worth of $7.7 million as of April 2025, which is remarkable for someone who started out as a state legislator in North Carolina. Even though political fortunes are not uncommon, Tillis stands out for the transparency with which his financial transactions paint a picture of aspiration, well-considered choices, and remarkably similar trends observed among a new generation of wealthy legislators.

Up to $1.6 million in trades attributed to Tillis were found by analysts parsing STOCK Act filings; this sum significantly indicates a purposeful and extremely effective investment strategy. According to financial insiders, the sale of $50,000 worth of AQFH stock in early 2017 was one of the more memorable and well-timed transactions. He sold his holdings in CASY, EPAY, and WAGE even earlier, in 2015. The profits from these investments highlight a carefully managed portfolio, as CASY has since increased by more than 400% and EPAY by more than 110%.

Tillis has established a solid financial foundation by utilizing publicly traded assets worth approximately $1.2 million. His strategy is especially creative when compared to colleagues who favor blind trusts or private equity. Notably, his portfolio activity puts him in the group of senators who continue to be active participants in the market while drafting the laws that have the potential to affect business operations. Even though this fact has generated public discussion and congressional scrutiny, Tillis continues to be remarkably transparent, which sets him apart in an environment where opacity is more prevalent than clarity.

Thom Tillis Bio & Financial Data

| Detail | Information |

|---|---|

| Full Name | Thomas Roland Tillis |

| Birth Date | August 30, 1960 |

| Age | 64 |

| Birthplace | Jacksonville, Florida, U.S. |

| Political Party | Republican |

| Spouse | Susan Tillis (married since 1987) |

| Children | 2 |

| Education | Chattanooga State CC, Univ. of Maryland (BS) |

| Net Worth (2025) | $7.7 million (Source: Quiver Quantitative) |

| Public Stock Assets | Approx. $1.2 million |

| Total Trades Recorded | Up to $1.6 million from STOCK Act filings |

| Senate Position | U.S. Senator, North Carolina (since 2015) |

| Committee Memberships | Judiciary, Finance, Banking, Veterans’ Affairs, Europe |

| Notable Bills Sponsored | S.1451, S.1441, S.1405, S.1335, S.1334 |

| Re-election Decision | Will not run in 2026 |

| Reference |

Tillis reported raising $2 million in the first quarter of 2025, ranking among the top 15 political contributors. Individual donors accounted for 54.8% of this total, suggesting a wide and unexpectedly grassroots appeal for a moderate Republican. Just under $462,000 was spent on his campaign during the same time period, demonstrating a prudent and controlled use of funds. He demonstrated that he was a well-prepared political operator by reporting $4 million in cash on hand at the end of the filing period.

From the speaker of the North Carolina House at the state level to a nationally renowned individual who has embraced bipartisan initiatives, Tillis has changed over the last ten years. His endorsement of the Bipartisan Safer Communities Act and the Respect for Marriage Act put him in the group of senators who are prepared to compromise on issues of principle when needed. Similar to individuals like Lisa Murkowski or Susan Collins, this has made him a pivotal swing vote during crucial legislative moments, even though it has occasionally caused him to drift away from his party’s far-right factions.

Tillis declared in June 2025 that he would not run for reelection in 2026. Although some found that decision surprising, it is remarkably similar to the departures of other well-known senators, including his North Carolina counterpart Richard Burr. According to political insiders, his exit could lead to board appointments or lucrative consulting positions, which former lawmakers like Senator Bob Corker and former Speaker Paul Ryan have already pursued.

Tillis continues to have a major impact on policy. His proposed laws cover topics like real estate taxes, veterans’ affairs, and disaster relief. One example of his ongoing responsiveness to constituents’ challenges on the ground is S.1451, which seeks to streamline federal aid procedures during national emergencies. In the meantime, S.1335 and S.1334 highlight a strong alignment with the interests of the financial sector by proposing tax code amendments that would benefit real estate investment trusts and insurance companies.

Tillis exemplifies a broader trend in contemporary American politics—the concurrent development of political capital and personal wealth—by fusing a career grounded in public service with a noticeably better personal fortune. The public is now more aware of the connection between congressional work and financial gain, thanks to Mitt Romney’s multimillion-dollar disclosures and Alexandria Ocasio-Cortez’s growing prominence. Even though Tillis’s publicly revealed investments are still the subject of ethical discussions, they seem less contentious in this light and more indicative of a transparent culture.

The level of access and documentation in the Tillis case is what makes it so obvious. Constituents can follow his net worth, stock transactions, and legislative actions in almost real time thanks to platforms like Quiver Quantitative. While not flawless, this openness is a change from previous decades when such information was hidden in lengthy documents or handwritten disclosures.

Now that he has decided against running for reelection, Tillis is in a position to influence policy in other ways, perhaps as a corporate board member, political advisor, or think tank contributor. His broad committee experience, especially in the judiciary and finance sectors, gives him a highly sought-after skill set. Thom Tillis becomes a case study in both financial literacy and public responsibility as society becomes more concerned with the wealth and accountability of elected officials.